Can stripping oil be deducted

.jpg)

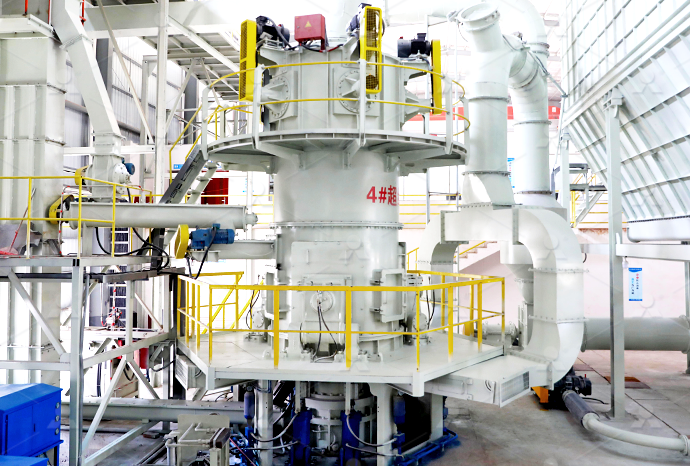

IAS 16 — Accounting for production phase stripping costs in the

2010年5月6日 explain why a stripping campaign is a component of another asset; make no comment on whether a stripping campaign component is tangible or intangible in nature; explain how it is possible to analogise the requirements in IAS 16 with respect to components to stripping campaign component shall be depreciated or amortised in a rational and systematic manner, over the specific section of the ore body that becomes directly accessible as a result Stripping Costs in the Production Phase of a Surface MineStripping costs that are part of a stripping activity should be accounted for as an addition to, or enhancement of, an existing asset (stripping component) The stripping component should be New guidance on accounting for stripping activities PwCBC6 The Committee decided that an entity may create two benefits by undertaking stripping activity (and incurring stripping costs) These benefits are the extraction of the ore in the STAFF PAPER January 2015 IFRS Interpretations Committee Meeting

.jpg)

IASB ISSUES INTERPRETATION ON STRIPPING COSTS BDO

If benefits from stripping activity is realised in the form of inventory produced, stripping costs must be accounted for under IAS 2 Inventories If stripping activity results in improved access to the However, the staff have noted through the outreach process that extraction of oil deposits in sands/shale can involve a process similar to stripping The implication is that entities mining oil IFRIC Meeting Agenda reference 2A Staff Paper• If there is a write off of an existing stripping asset on 1 January 2014, will this need to be applied retroactively or can the amount be deducted directly in 2014? • That the tax law provides Global Energy, Utilities Mining Group/ August 2013 / No 48Routine stripping costs that are not incurred as part of the stripping activities are accounted for as current costs of production in accordance with IAS 2 The benefits from stripping activities that IFRS AT A GLANCE IFRIC 20 Stripping Costs in the Production

Straight away PwC

IFRIC 20 applies only to stripping costs that are incurred in surface mining activity during the production phase of the mine It does not address underground mining activity or oil and PreProduction: expenses incurred for the purpose of bringing a new mine into production in reasonable commercial quantities (including expense for clearing, removing overburden, Treatment of Expenditures in Canada Mining Tax CanadaIn some cases the full amount of the expenditure can be deducted in the taxation year in which it is incurred, similar to the accounting concept of a current expense Examples of such expenditures are most employee payroll expenses and other amounts where the benefit of the expenditure is largely realized in the immediate year rather than over more than one yearTreatment of Expenditures in Canada Mining Tax Canada2019年6月3日 You can take this deduction even if you use the standard mileage rate or if you don’t use the car for business If you are selfemployed and use your car in your business, you can deduct the business part of state and local personal property taxes on motor vehicles on Schedule C (Form 1040), Schedule CEZ (Form 1040), or Schedule F (Form 1040)Solved: What expenses are included in the standard deduction

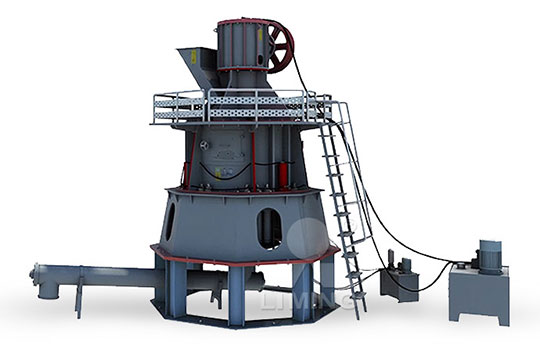

Stripping Operation In Oil Gas Well Control

2017年12月22日 Application During operations on drilling or producing well, a sequence of events may require tubing, casing, or drill pipe to be run or pulled while annular pressure is contained by blowout preventers; such practice is 2020年5月11日 Repairs can be deducted immediately if the total amount paid for repairs and maintenance on the property is $10,000 or under, or 2% of the unadjusted basis of the property, whichever amount is less This safe harbor is only available for businesses with revenues under $10 million and when the property being repaired has an unadjusted basis under $1 millionTax Rules for Deductions on Repairs and MaintenanceThis section is for expenses not deducted elsewhere For each entry, list the type and amount Use the green Add button to add additional expenses into this section Program Entry Qualified Expenses relating to your business income can be deducted in the expenses section of your Schedule C To enter your expenses for your business, go to What expenses can I list on my Schedule C? – Support2021年8月3日 These are called estate tax deductions and can often be overlooked These deductions will typically include any funeral expenses, debts and loans that you owed at your date of death, and any costs incurred to administer the assets of your estate This process can be a bit of a headache if the financial affairs are not adequately organized50 LittleKnown Deductions to Lower Your Estate Tax

.jpg)

STAFF PAPER January 2015 IFRS Interpretations Committee Meeting

undertaking stripping activity (and incurring stripping costs) These benefits are the extraction of the ore in the current period and improved access to the ore body for a future period The result of this is that the activity creates an inventory asset and a noncurrent asset 112018年11月6日 If the property is a rental and you do not live in it at all, you must report all income and can generally deduct all outofpocket expenses in full So, if you buy heating oil and provide this for your tenants to use, you can itemize and deduct the expense on your annual tax return You generally deduct expenses in the year that you pay themCan I Deduct Heating Oil Expenses? Pocketsense2021年10月1日 If they are not required to be capitalized under the rules discussed in this section or any other provision (such as the UNICAP rules under Sec 263A), amounts paid for repairs and maintenance can be deducted currently (Regs Sec 1 1624 (a)) Buildings and building systemsCapitalized improvements vs deductible repairs The Tax 2024年2月2日 Here’s some good news! The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act (IRA) of 2022 So, if you made any qualifying home improvements to your primary residence after December 31, 2021, you may be eligible to claim them on your taxes when you file for 2022The Tax Credits for Energy Efficient Upgrades are Back!

.jpg)

Tax return Germany 49 deductible expenses

2024年1月6日 Here you can find the types of expenses that can be deducted from your tax with the Steuererklärung – Germany tax return What exactly does this mean? You will get some money back if you declare them as expenses 2010年2月16日 Can utilities and taxes be deducted from the inheritance tax return? If no one is living in the estate after my father's death (mother already passed) In addition to the funeral costs etc, can I deduct the utilities and taxes I have paid during the 3 months after his death, Can utilities and taxes be deducted from the inheritance tax Which of these can be deducted on Schedule A (Form 1040), Itemized Deductions, line 16, as an Other Itemized Deduction? Impairmentrelated work expenses of a disabled person Tax return preparation fee Unreimbursed cleaning of a nurse's uniform Unreimbursed subscription to a trade publication related to the taxpayer's workSolved Question 17 of 73 Which of these can be deducted on2019年5月31日 You can claim deductible business auto expenses in one of two ways IRS Mileage Rate: You can claim business miles times the IRS mileage rateIRS mileage rates for business activities are $555/mile Actual Cost:You can claim your actual costs including depreciation times the percentage that you use your car for businessActual costs would I use my personal vehicle for work every day Can I write off my car

.jpg)

Can I deduct oil changes? TaxAudit Blog

2020年11月12日 There is a very good chance that you can indeed deduct the cost of your oil changes if you use your car or truck for business purposes But before we go any further down that road, we should point out that deducting actual oil change expenses might not be the best path to take in your situation How to Deduct Vehicle Expenses2023年8月16日 How Much Can a Landlord Charge for Painting Costs? If the landlord determines that the tenant damaged the paint, they can charge the tenant for the cost of materials and labor Landlords can demonstrate a reasonable cost for materials by saving receipts and only charging for the materials neededCan a Landlord Charge for Painting Costs?2019年6月6日 Can cannabidiol (aka hemp oil) which is now legal be deducted as a medical expense? Over the counter drugs are not deductible If your doctor prescribed it, then yesCan cannabidiol (aka hemp oil) which is now legal be deducted 2024年11月15日 The extraction of oil and gas involves lease and lease bonus payments paid to the landowner These payments can be lumpsum or multiyear payments For royalty owners, the lease bonus and lease payments are generally reported on Form 1099MISC, Box 1, Rents This amount should be reported as income on Schedule E, page 1, as Rents ReceivedBasic tax reporting oil and gas 1099MISC royalties Intuit

A Guide to Business Expense Deductions for Cannabis Companies

When you can utilize 280E best practices and authenticate COGS, expenses and labor hours, you may be able to offset unnecessary tax payments We can also help your cannabis business avoid behaviors related to money laundering, which can be especially common for allcash businesses2024年7月1日 Who exactly can claim these tax deductions? If you’re selfemployed, then you can claim these income tax deductions The Internal Revenue Service (IRS) defines selfemployment as carrying on a trade or business as a sole proprietor, independent contractor, singlemember LLC, or as a member of a partnership Even if your small business isn’t making The Ultimate List of 34 Tax Deductions for SelfEmployed Business • The taxpayer can deduct up to 30% of the CCDE pool at the end of each year (but is restricted if it is a short year) This deduction is PwC optional • CDE can be claimed whether or not the corporation has income; that is, by claiming CDE, the taxpayer can create a loss, eligible for carryback or carryforwardpwc 2012 Americas School of MinesTypes of expenses that can be deducted are any 'ordinary and necessary costs' incurred in operating a farm (Note: This is not a complete list) Examples of farming expenses that can be deducted: Business Use of Your Home (must use exclusively and regularly) Car and Truck expenses; Chemicals; Depreciation; Feed; Fertilizer; Gasoline, fuel and oilFarming Expenses: What can and cannot be deducted? Support

Tax Rules for Deductions for Repairs and Maintenance

2024年6月18日 Repairs can be deducted immediately if the total amount paid for repairs and maintenance on the property is $10,000 or under, or 2% of the unadjusted basis of the property, whichever amount is less This safe harbor 2021年7月8日 The following is a guide to allowable business expenses that can be deducted from your income taxes using Schedule C If you have any questions about whether you are taking full advantage of these deductions, or need more information, please contact us Vehicles—mileage, operating costsGuide to Deductible Business Expenses, Schedule C FBP CPAMiles driven for medical purposes (to and from chemotherapy, for example) can be deducted at a rate of $022 per mile in 2023 Miles driven by Armed Forces members for relocation purposes can also be deducted at a rate of $022 per mile in 2023 Miles driven in service of an approved charitable organization can deduct $014 per mile in 2023Writing off a Car for Business: IRS Rules Hourly, IncThis includes the cost of land, exploration rights, licenses, permits, leases, well, and royalty interests in an oil and gas property in Canada COGPE can be deducted at a 10% declining rate (subject to proration for short taxation years) Unclaimed balances can Schedule 12, ResourceRelated Deductions Wolters Kluwer

.jpg)

Are home renovations tax deductible in Canada? MoneySense

2024年4月12日 What is the Oil to Heat Pump Affordability Program? This program may be applicable for you, Joan It provides up to $10,000 to convert your oil heating to a heat pump2023年10月5日 The ability to write off tools as workrelated expenses is a valuable benefit Here's a breakdown of who can benefit from this tax advantage: SelfEmployed Professionals If you're a selfemployed individual, such as an independent contractor or freelancer, you can generally deduct tools and equipment used in your trade or businessCan You Write Off Tools for Work? 2023 Deductions GuideTypical bulk insulation products can qualify, such as batts, rolls, blowin fibers, rigid boards, expanding spray, and pourinplace Products that air seal (reduce air leaks) can also qualify, as long as they come with a Manufacturers Certification Statement, including: Weather stripping; Spray foam in a can, designed to air sealInsulation Tax Credit ENERGY STAR2021年9月1日 1 H NMR provides mechanistical insights on accelerated shelflife conditions Temperature and oil stripping lead to more trans–trans diene hydroperoxides Stripping antioxidants favours the formation of hydroperoxides between double bonds • Increasing P O2 accelerates lipid oxidation, with limited impact on the mechanisms Small amounts of LC Evaluation of oxygen partial pressure, temperature and stripping

36.jpg)

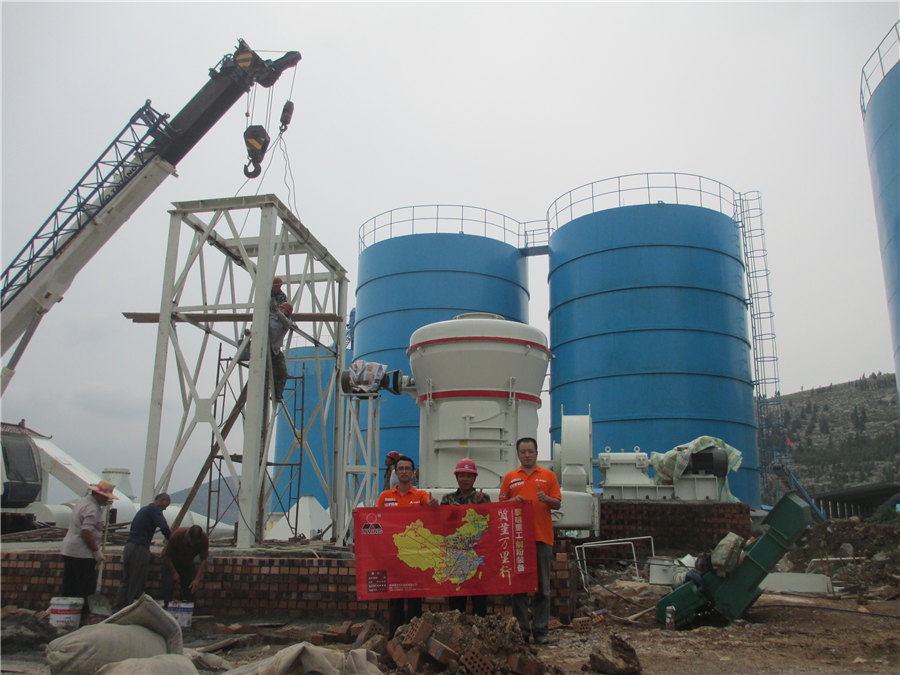

Treatment of Expenditures in Canada Mining Tax Canada

In some cases the full amount of the expenditure can be deducted in the taxation year in which it is incurred, similar to the accounting concept of a current expense Examples of such expenditures are most employee payroll expenses and other amounts where the benefit of the expenditure is largely realized in the immediate year rather than over more than one year2019年6月3日 You can take this deduction even if you use the standard mileage rate or if you don’t use the car for business If you are selfemployed and use your car in your business, you can deduct the business part of state and local personal property taxes on motor vehicles on Schedule C (Form 1040), Schedule CEZ (Form 1040), or Schedule F (Form 1040)Solved: What expenses are included in the standard deduction 2017年12月22日 Application During operations on drilling or producing well, a sequence of events may require tubing, casing, or drill pipe to be run or pulled while annular pressure is contained by blowout preventers; such practice is Stripping Operation In Oil Gas Well Control2020年5月11日 Repairs can be deducted immediately if the total amount paid for repairs and maintenance on the property is $10,000 or under, or 2% of the unadjusted basis of the property, whichever amount is less This safe harbor is only available for businesses with revenues under $10 million and when the property being repaired has an unadjusted basis under $1 millionTax Rules for Deductions on Repairs and Maintenance

.jpg)

What expenses can I list on my Schedule C? – Support

This section is for expenses not deducted elsewhere For each entry, list the type and amount Use the green Add button to add additional expenses into this section Program Entry Qualified Expenses relating to your business income can be deducted in the expenses section of your Schedule C To enter your expenses for your business, go to 2021年8月3日 These are called estate tax deductions and can often be overlooked These deductions will typically include any funeral expenses, debts and loans that you owed at your date of death, and any costs incurred to administer the assets of your estate This process can be a bit of a headache if the financial affairs are not adequately organized50 LittleKnown Deductions to Lower Your Estate Taxundertaking stripping activity (and incurring stripping costs) These benefits are the extraction of the ore in the current period and improved access to the ore body for a future period The result of this is that the activity creates an inventory asset and a noncurrent asset 11STAFF PAPER January 2015 IFRS Interpretations Committee Meeting2018年11月6日 If the property is a rental and you do not live in it at all, you must report all income and can generally deduct all outofpocket expenses in full So, if you buy heating oil and provide this for your tenants to use, you can itemize and deduct the expense on your annual tax return You generally deduct expenses in the year that you pay themCan I Deduct Heating Oil Expenses? Pocketsense

.jpg)

Capitalized improvements vs deductible repairs The Tax

2021年10月1日 If they are not required to be capitalized under the rules discussed in this section or any other provision (such as the UNICAP rules under Sec 263A), amounts paid for repairs and maintenance can be deducted currently (Regs Sec 1 1624 (a)) Buildings and building systems2024年2月2日 Here’s some good news! The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act (IRA) of 2022 So, if you made any qualifying home improvements to your primary residence after December 31, 2021, you may be eligible to claim them on your taxes when you file for 2022The Tax Credits for Energy Efficient Upgrades are Back!